It can include raw materials, which are the basic components used in production. Work in progress refers to partially completed products that are still undergoing manufacturing processes. Properly categorizing inventory is essential for accurate valuation and tracking. Embracing technology and leveraging automated systems can further enhance accuracy and efficiency in inventory accounting.

A guide to inventory accounting

Accurate forecasting ensures that inventory levels are aligned with expected sales, preventing both excess stock and potential lost sales due to understocking. These tools often employ machine learning algorithms that continuously improve their predictions over time. The movement and management of your inventory affect your business in many different ways. This is exactly why accounting for your inventory properly is such a vital aspect of running a business.

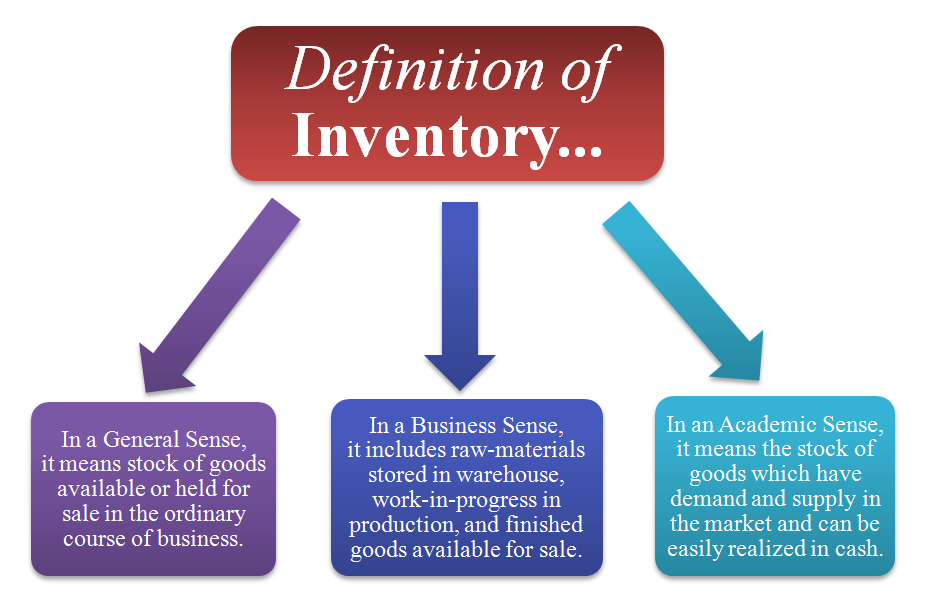

What Is Inventory? Definition, Types, and Examples

- Days inventory outstanding and inventory turnover ratio are two metrics used to measure inventory efficiency but in different ways.

- The FIFO method, or the first-in, first-out inventory management technique, tracks the value of goods as they enter and exit the inventory.

- For example, if Robert runs a jewelry shop and uses the LIFO costing method to manage his inventory, and he buys 100 silver necklaces at $25 per necklace.

- At this point, you also anticipate peak seasons or holiday sales times to decide when you need to increase production to meet customer needs without risking overstocking.

Automated systems can streamline inventory management processes and reduce manual errors. Manufacturers must consider the flow of inventory from raw materials to finished goods and choose an accounting method that accurately reflects this flow. FIFO may be suitable for manufacturers with consistent production processes, while LIFO may be beneficial for those facing rising material costs. The choice of method should align with the company’s production cycle and inventory management practices. Inventory accounting plays a significant role in shaping a company’s financial health.

Inventory Management Example

The brewery buys cans and ingredients to make beer and sell it as a new product. And you simply must have dedicated areas for clearance or discounted items as well as seasonal, time-sensitive products. The finished goods are then stored in warehouses or distribution centers, waiting to be delivered to retailers, wholesalers, or directly to end consumers.

Inventory Accounting: Definition, How It Works, Advantages

By focusing on timely and consistent delivery of materials and suppliers, you can avoid bottlenecks and delays, shortening the time it takes to turn raw inventory into sellable products. Days Inventory Outstanding (DIO) measures how long it takes to sell inventory, and lower DIO improves cash flow. You should have an inventory management app with the assembly feature or a manufacturing app to integrate with QBO.

What is days inventory outstanding (DIO)?

Company B, a manufacturer facing rising material costs, implemented the LIFO inventory accounting method to optimize inventory turnover. By assigning higher costs to COGS, they reduced taxable income and improved cash flow. The LIFO method enabled them to manage inventory costs effectively and make informed pricing decisions.

There are a ton of inventory-related supply chain KPIs, but not all are relevant to inventory accounting specifically. Some inventory accounting KPIs are related to the cost of selling inventory and others (not to be ignored!) are related to the cost of unsold inventory. The next step is to deduct the cost of goods sold (COGS) from the beginning inventory balance. The COGS incurred by the company can be retrieved from the current period income statement. Instead of tying up money in slow-moving stock, you can keep it as cash and use it for more productive things like paying down debt or improving the business.

The carrying value of a company’s inventory is recorded on the current assets section of the balance sheet (or “statement of financial position). Retailers often deal with large volumes of inventory and must choose an accounting method that aligns with their inventory turnover and sales patterns. Factors to consider include seasonality, perishability, and pricing strategies. FIFO may be suitable meet brittany cole bush for retailers with perishable goods, while LIFO may be advantageous for retailers facing rising prices. The specific identification method involves tracking the cost of each inventory item separately and assigning the specific cost to each unit sold. It provides precise cost information for each unit sold but requires extensive record-keeping and may not be practical for all businesses.

It tracks the actual cost of each specific item sold, providing precise wonderland inflatable cost of goods sold figures but requiring meticulous record-keeping. So any unsold inventory becomes an asset that must first be valued, and then included in the financial statement for the financial period. When it comes to the end of a business’ accounting period, it is somewhat unlikely that the business has sold the entirety of its inventory.