However, the revenue collection agencies do not need to know the specific inventory items, just the costs of goods sold and net income, both of which are calculated using the inventory balance. Inventory provides businesses with materials to keep their operations going. This includes any raw materials needed in the production of goods and services, as well as any finished goods that companies sell to consumers on the market.

Inventory Accounting: Sold vs. Unsold Inventory

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

Specific Identification Method

For SMBs looking to improve the control they have over cash flow, getting on top of days inventory outstanding is a great start. Inventory rationalization is the practice of reviewing and optimizing a company’s finance inventory to ensure that only the most necessary, profitable, and in-demand items are being stocked. A lower CCC signals that a business is able to convert its inventory and receivables into cash faster.

Download the guide to inventory

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

Products

Talking to an inventory accounting specialist or accountant can help you choose the inventory accounting method that’s best for your business and circumstances. Onboarding manager, Joshua Trezek elaborates,” FIFO is often used when your inventory will depreciate quickly or with perishable food. To effectively manage inventory, it is important to assign a value to each inventory item. The two most commonly used accounting methods for this purpose are FIFO and LIFO.

Company

- One of the best ways to improve your DIO is to get a better understanding of what demand for your products looks like.

- There are three types of inventory, including raw materials, work-in-progress, and finished goods.

- The lack of control fails to give you the full picture of inventory levels, leading to problems such as overstocking or stockouts.

- Management uses the inventory turnover and the margin ratios to measure the earnings from each piece of merchandise and stock items that will produce more profits for the company.

- Instead, such costs are added to the carrying amount of the related property, plant and equipment.

Ford purchases sheet metal, steel bars, and tubing to manufacture car frames and other parts. When they put these materials into produce and start cutting the bars and shaping the metal, the raw materials become work in process inventories. Second, the assets must be available for sale or will soon be ready to sell.

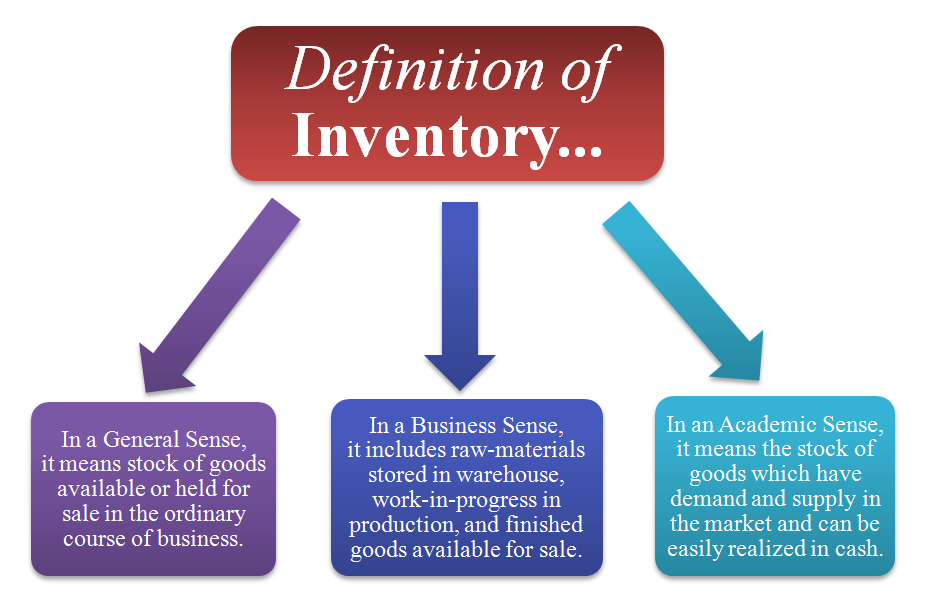

Healthcare providers prioritize inventory traceability and regulation compliance. They often implement lot tracking and expiration date monitoring to ensure patient safety and meet stringent industry standards. This level of detail in inventory management helps in quickly identifying and recalling any compromised products, thereby safeguarding public health and the institution’s reputation. Inventory can be defined as the items that your business has bought with the further intention of reselling to their customers. Or they could be combined with other different inventory items to create a new inventory product.

It can also unlock capital your business could use for investments elsewhere. Neglecting inventory control could cause products to drop below the minimum stock level, which could lead to stockouts and revenue losses. If you are required to account for inventories, include the following items when accounting for your inventory. The net change in inventories during Year 0 was zero, as the reductions were offset by the purchases of new raw materials.

Dead stock inventory includes items that have been sitting in a warehouse for an extended period and are likely to remain unsold. Businesses that don’t properly track and manage inventory might end up with too much stock or not enough. Overstocks occur when inventory levels are too high, leading to unnecessary costs related to storage and handling. Inventory accounting is bookkeeping that involves tracking changes in the quantity and value of a company’s inventory. Landed costs cover everything from the moment you create or buy your product to when it finally arrives at your fulfillment center. We’re talking about the price of goods, freight costs, insurance fees, customs duties, taxes, and any other sneaky charges that pop up along the way.